Green FinTech is an initiative by the Monetary Authority of Singapore (MAS) that combines technology and sustainability to shape the future of financial services, and quicken the decarbonization of Singapore’s economy.

Singapore has been a leading FinTech hub since 2015, and the Green Finance Action Plan was launched in 2019 to address challenges in the green finance space.

Project Greenprint is a core component of Green FinTech aiming to leverage technology and data to create a transparent, trusted, and efficient ESG ecosystem for green and sustainable finance.

Its objectives include:

MAS collaborates with industry partners to develop digital utilities enabling efficient and trusted ESG data flows and promoting a green finance ecosystem.

The project addresses data gaps in sustainability financing, enabling financial institutions to allocate capital effectively, monitor commitments, and measure impact.

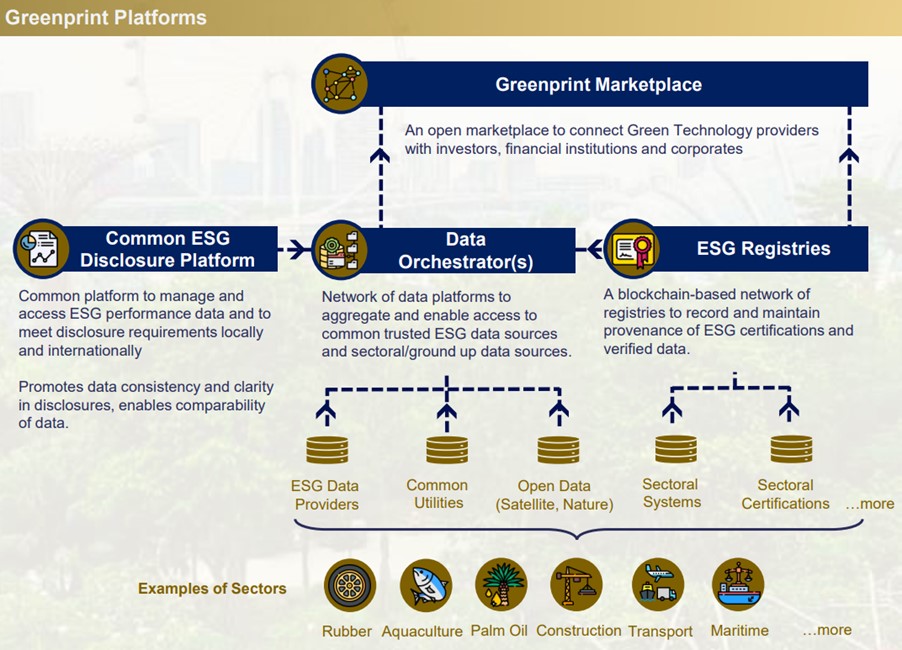

The data orchestrator compiles sustainability information from various sources, including major ESG data providers, utility companies, the ESG Disclosure Portal, and other industry-specific platforms, GreenON, Olam International and SGTraDex. By offering consent-based access to these sources, the platform allows for the generation of new data insights through analytics, to enhance the investment and financing decision-making processes.

The Greenprint ESG Registries was launched in May 2022 and developed in partnership with Hashstacs Pte Ltd (STACS). It aims to create a blockchain-based data platform for storing tamper-proof sustainability certifications and verified sustainability data across various industries. The platform provides a shared access point for financial institutions, corporations, and regulators, enabling better tracking and analysis of sustainability commitments, impact measurement, reducing greenwashing risks, and enhancing the management of ESG financial products.

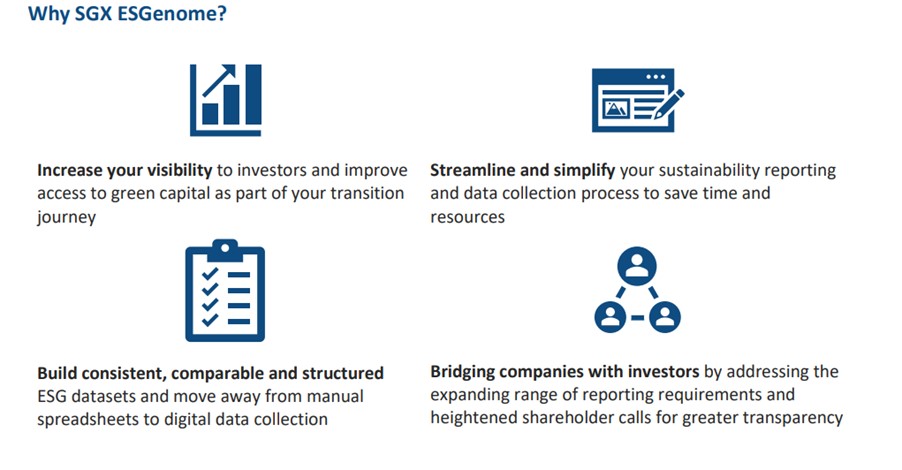

The common ESG disclosure platform also known as SGX ESGenome, aims to simplify sustainability reporting and improve access to ESGdata. Companies can submit their corporate-level sustainability information to the portal, which will then be organized according to various standards and frameworks. This addresses the current challenges faced by corporations that must report using different systems, templates, and formats.

SGX recommends 27 core ESG metrics (“Core ESG Metrics”) for companies to use when starting to work on a sustainability reporting. While this is aimed at large companies, it is useful to know which metrics are more commonly considered.

The Greenprint Marketplace promotes the development of a dynamic green fintech ecosystem by linking greenfintech and green technology providers with investors, financial institutions, and corporations. This digital platform features curated listings of solution providers, those seeking solutions, and investors, with the aim of fostering collaboration, accelerating partnerships, and directing investments towards environmentally friendly and sustainable solutions and projects. The platform is anticipated to launch in 2023.

To foster collaboration between ESG FinTech start-ups, solution providers, financial institutions, and real economy stakeholders, the ESG Impact Hub was launched in October 2022 by MAS.

The Hub aims to accelerate the growth of Singapore's ESG ecosystem by:

The hub aims to facilitate the development of technology solutions addressing ESG needs, organize key initiatives such as accelerator programs and workshops, and support sectoral transition efforts.

Please note that this summary page has been compiled from the content of the SG Greenprint website.